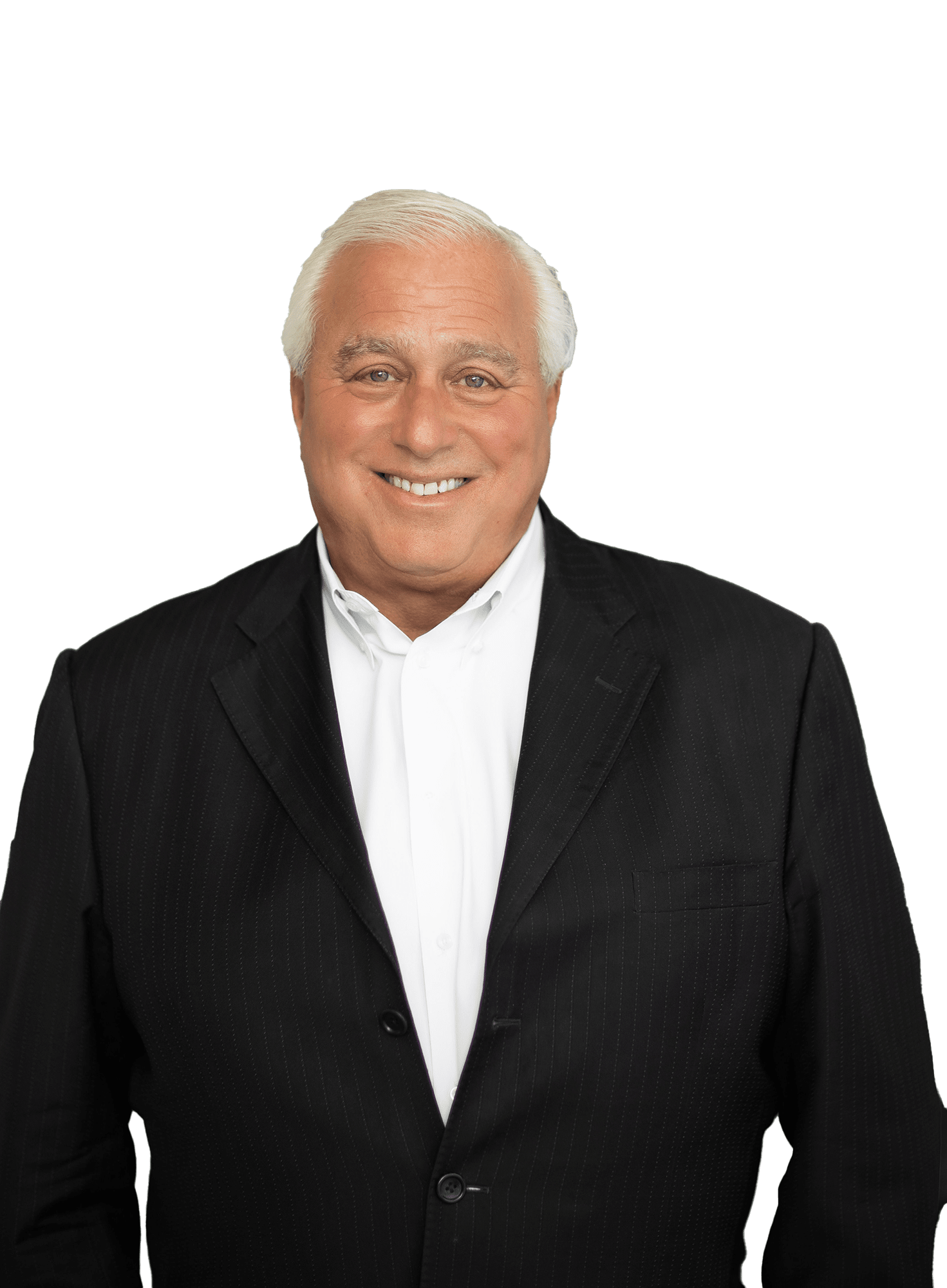

Ed Butowsky's Financial Career

With over 35 years of experience in the financial services industry and as an award-winning wealth advisor, Ed Butowsky has left an indelible mark on the landscape of wealth management. His journey began at Morgan Stanley, where he ascended to the prestigious position of Senior Vice President in private wealth management.

First Wealth Advisor to Surpass $1 Billion in Assets

Remarkably, over his 18-year tenure, Ed Butowsky not only claimed the title of the firm's top producer nationwide but also achieved the remarkable feat of being the first advisor to surpass one billion dollars in assets under management.

Ed Butowsky launched Chapwood Investments, LLC in 2005, a private wealth management advisory firm focusing on providing comprehensive financial counseling and investment advice to wealthy families and individuals.

Expert Wealth Advisor

As a wealth advisor, Ed Butowsky stands as the epitome of professionalism and proficiency. His legacy is not just in numbers but in the impact he's had on the financial well-being of individuals and the confidence held in their investment portfolios.

Place your trust in Ed to navigate the intricacies of wealth management and preservation, where each decision is not just informed and strategic but meticulously crafted to safeguard and fortify your financial future.

Ed Butowsky’s Experience with:

Guest Speaking & Television Interviews

Ed Butowsky is a frequent guest on major news networks like CNN, ABC, CBS, NBC, CNBC, Fox Business News, FOX News Channel, Bloomberg TV, and China TV. He's a regular contributor to FoxBusiness.com, sharing insights on wealth management and global financial events. Ed has been featured in the online reality series "The Invested Life" and lectures at esteemed institutions like Yale University and NYU’s Stern School of Business.

Professional Athlete Wealth Preservation & Growth

Ed Butwosky's wealth management expertise has become synonymous with safeguarding and expanding the financial portfolios of professional athletes. His unique insights not only address the challenges but also pave the way for sustainable wealth growth, ensuring that athletes can enjoy the fruits of their labor long into the future.

Ed Butowsky isn't just a financial advisor; he's a trusted partner dedicated to securing the financial legacies of those who've dedicated their lives to the pursuit of excellence in sports and in life!

High-Net-Worth Wealth Management

Picture this: a financial advisor who doesn't just acknowledge your challenges as a high net-worth individual but anticipates them. Ed Butowsky's experience with high-net-worth wealth management is not just about managing wealth; it's about understanding the dynamic nature of your financial world and tailoring strategies that evolve with it.

For professional athletes, the financial game is as competitive as the sports arena. Ed Butowsky's insights, as featured in the Sports Illustrated 2009 article, "How (and Why) Athletes Go Broke," and the ESPN 30 for 30 documentary, "Broke," shed light on the financial pitfalls athletes may encounter. Ed Butowsky doesn't just empathize with your financial concerns; he's been a guiding force for those who've faced similar challenges.

Ed Butowsky isn't just a wealth advisor; he's a trusted confidant who understands the unique struggles you face. The journey to secure your financial future begins with someone who comprehends the nuances of your world.

Ed is that someone – an expert in high net worth wealth management and a reliable partner who thrives on turning financial challenges into tailored solutions. When the financial stakes are high, Ed Butowsky is the strategic advantage you can’t afford to NOT have on your side!